Regional Rural Bank is a Government bank with having presence in Rural India recruiting various positions through IBPS. The Recruitment process and details of examinations are listed below for the understanding of students. You can crack this selection process with the help of the best Bank coaching class in Chennai.

Recruitment Process and Examinations for Regional Rural Bank Job:

There are different selection procedures that are followed for various posts of Regional Rural Bank Careers. The 3 stages involved in IBPS RRB Selection Process for Office Assistant and Officer Scale I are:

· IBPS RRB Preliminary Examination 2023

· IBPS RRB Main Examination 2023

· IBPS RRB Interview Round (Only for Officer Scale I)

The stages involved in the IBPS RRB PO Selection Process for the recruitment of Officer Scale II and Officer Scale III are:

· IBPS RRB Single Online Test

· IBPS RRB Personal Interview 2023

Overview of the selection process for Regional Rural Bank jobs.

The IBPS RRB 2023 selection procedure for Officer Scale I has three phases - prelims, mains, and interviews. Applicants qualifying for the IBPS RRB preliminary exam are eligible to appear for the mains exam. The marks of the IBPS RRB mains exam and interview are taken into account for preparing the final merit list. Selected candidates are recruited as Assistant Managers in the different Regional Rural Banks

The IBPS RRB Officer Scale II and III exams have one computer-based test. The IBPS RRB 2023 Officer Scale II and III selection procedure also has an interview stage. Applicants shortlisted in the single window CBT exam are eligible to appear for the interview. The merit list is prepared on the basis of the CBT exam and interview. Check the tables below for IBPS RRB 2023 Officer Scale II and III selection process.

Written examinations: Exam pattern, syllabus, and preparation tips for Regional Rural Bank jobs

ONLINE EXAMINATION STRUCTURE OF THE REGIONAL RURAL BANK EXAM

The structure of the Examinations which will be conducted online are as follows:

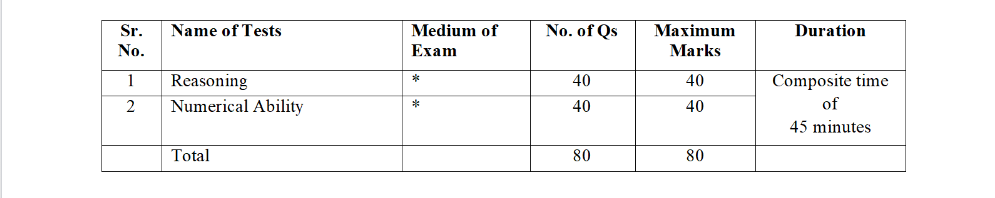

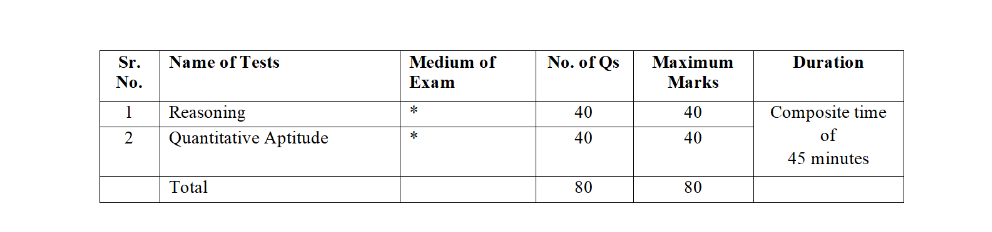

Preliminary Examination (objective) *

Office Assistant (Multipurpose)

Officer Scale-I

** Candidates (for both posts) have to qualify in both the tests by securing minimum cutoff marks. Adequate number of candidates in each category, depending upon requirements, will be shortlisted for Online Main Examination.

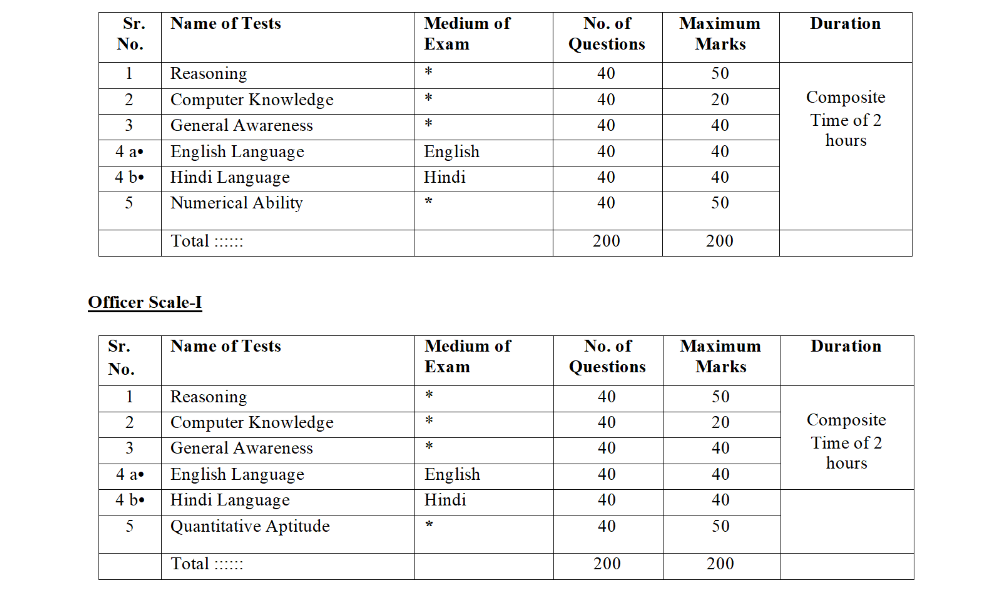

Main Examination (objective)

Office Assistant (Multipurpose)

Preparation tips For the Regional Rural Bank jobs :

Interview round for Regional Rural Bank Career: Key aspects to focus on and how to stand out.

Technical Knowledge: Banks typically require candidates to have a solid understanding of financial concepts and banking operations. Interviewers may ask questions related to accounting, financial analysis, risk management, regulations, and other relevant topics.

Customer Service Skills: Banks value candidates who can provide excellent customer service. They may assess your ability to handle customer inquiries, resolve issues, and communicate effectively with clients.

Problem-Solving and Analytical Skills: Banks often face complex problems and require employees who can think critically and analyze situations. You may be presented with hypothetical scenarios or asked to solve real-world banking problems during the interview.

Communication and Interpersonal Skills: Strong communication skills are crucial in a bank setting. Interviewers may evaluate your ability to articulate your thoughts clearly, listen actively, and work well with a diverse range of colleagues and clients.

Ethical Awareness: Banks place a high emphasis on ethics and integrity. You may be asked situational questions that assess your ethical decision-making abilities and your understanding of confidentiality and compliance requirements.

Teamwork and Collaboration: Collaboration is essential in a banking environment. Interviewers may assess your ability to work effectively in teams, delegate tasks, and build positive working relationships.

Stress Management: The banking industry can be fast-paced and stressful. Interviewers may gauge your ability to handle pressure, meet deadlines, and maintain composure in challenging situations.

Adaptability and Learning Agility: Banks undergo constant changes due to evolving regulations, technologies, and market conditions. Interviewers may ask about your willingness to learn, adapt to new processes, and embrace innovation.

Industry Knowledge: Demonstrating an understanding of the banking industry, current trends, and the bank's specific products and services can set you apart from other candidates. Stay updated on the latest industry news and advancements.

Professionalism and Appearance: Banks typically have professional dress codes and expect candidates to present themselves accordingly. Ensure that you are well-groomed and dressed in appropriate business attire.

Recommended study materials and resources.

Nesto Institute, the best Bank coaching institute in Chennai prepared the study material exclusively for Regional Rural banks and it is more than sufficient for students to crack the RRB exam.

Time management strategies for exam preparation.

Effective time management is crucial when preparing for RRB exams to ensure that you cover all the necessary topics and maximize your chances of success. Here are some time management strategies to help you with your RRB exam preparation. And you can achieve the job with the help of a good Bank coaching classes in Chennai.

Create a study schedule: Design a study schedule that outlines specific time slots for each subject or topic. Allocate more time to subjects or topics that require additional attention or are more challenging for you. Set realistic goals for each study session to stay focused and motivated.

Prioritize topics based on weightage: Understand the exam pattern and syllabus, and prioritize topics based on their weightage in the exam. Give more emphasis to high-scoring subjects or topics to ensure you allocate sufficient time to cover them thoroughly.

Break down your study sessions: Instead of studying for long, uninterrupted periods, break down your study sessions into shorter, focused segments. Research suggests that studying in chunks with breaks in between helps improve retention and concentration. For example, study for 45-60 minutes and take a short break of 10-15 minutes before moving on to the next topic.

Utilize productive study techniques: Adopt effective study techniques that suit your learning style, such as summarizing important concepts, creating flashcards, or practicing with mock tests. Experiment with different techniques to identify what works best for you and helps you retain information efficiently.

Set daily and weekly targets: Set specific targets for each day and week to track your progress. Break down your study plan into manageable tasks and aim to accomplish them within the defined time frame. Meeting these targets will give you a sense of achievement and keep you motivated throughout your preparation journey.

Practice time-bound mock tests: Regularly practice mock tests and previous years' question papers under timed conditions. This will help you improve your speed and accuracy, simulate the exam environment, and identify areas that require further attention. Analyze your performance and focus on areas where you need to strengthen your knowledge or speed.

Prioritize quality over quantity: While it's important to cover the entire syllabus, prioritize understanding the concepts thoroughly rather than rushing through topics. Focus on grasping the underlying principles and solving practice questions to gain confidence in applying your knowledge.

Avoid multitasking and distractions: During your study sessions, minimize distractions such as social media, notifications, or unrelated tasks. Dedicate your focused attention to the study material at hand. Multitasking can reduce efficiency and hinder effective learning.

Take care of your well-being: Ensure you get enough sleep, eat well, and exercise regularly. Taking care of your physical and mental well-being will enhance your concentration, memory, and overall productivity during your study sessions.

Remember, each individual's study approach may vary, so adapt these strategies to suit your needs and preferences. Regular revision and consistent effort, coupled with effective time management, will significantly contribute to your success in RRB exams.

Mock tests and previous years' question papers.

Nesto Institute, the leading back coaching center in Chennai conducts mock tests regularly as per the RRB exam for the students to have good practice and to know the preparation level.

NESTO provides exclusive Bank exam training in Chennai and support for its clientele who are among the Who’s Who in the financial services industry.

1. Capital Market .( security analysis/Financial Risk Management/Financial Modelling/Derivatives).

2. Banking Regulation and Compliance.

3. Finance for Non-finance executives.

4. International Banking and Finance

5. Statutory requirements.

Tips for Cracking RRB Job Interviews:

Cracking RRB exams requires thorough preparation, smart strategies, and a focused approach. Here are some tips to help you increase your chances of success:

Understand the Exam Pattern and Syllabus: Familiarize yourself with the exam pattern and syllabus of the RRB exam you are appearing for. Understand the sections, marks distribution, and time allocation for each section. This knowledge will help you plan your preparation effectively.

Create a Study Plan: Develop a well-structured study plan that covers all the subjects and topics in the syllabus. Divide your time wisely, allocating more time to challenging areas while ensuring you cover all subjects adequately. Set daily and weekly targets to keep track of your progress.

Study Material and Resources: Gather the right study materials, including textbooks, reference books, previous years' question papers, and online resources. Ensure that the study material is relevant, up-to-date, and aligned with the exam syllabus. Make use of online platforms, mobile apps, and video tutorials for additional learning resources.

Focus on Basics and Fundamentals: Build a strong foundation by understanding the basic concepts and fundamentals of each subject. Strengthen your grasp on the core principles to solve complex problems and apply concepts effectively during the exam.

Practice Regularly: Practice is key to cracking RRB exams. Solve a wide range of practice questions and previous years' papers to get familiar with the exam pattern, improve your problem-solving skills, and manage time effectively. Additionally, consider taking mock tests to simulate the exam environment and evaluate your performance.

Time Management: Develop effective time management skills to ensure you complete the exam within the allotted time. Practice solving questions within time limits during your preparation. Identify time-consuming sections and work on strategies to solve them efficiently.

Develop Exam-Specific Techniques: Understand the marking scheme and optimize your exam approach accordingly. Learn techniques like intelligent guessing, eliminating options, and time-saving shortcuts to maximize your score. Be mindful of negative marking and answer questions only when you are reasonably sure of the correct answer.

Stay Updated with Current Affairs: RRB exams often include a section on current affairs and general awareness. Stay updated with the latest national and international news, government schemes, banking and financial developments, and relevant topics for the exam.

Revise and Review: Regular revision is crucial to retain information and reinforce your understanding. Set aside dedicated time for revision and review important concepts, formulas, and key points. Create summary notes or flashcards for quick revision.

Stay Calm and Confident: Maintain a positive mindset and stay calm during the exam. Manage exam stress by practicing relaxation techniques and maintaining a healthy lifestyle. Believe in yourself, trust your preparation, and approach the exam with confidence.

Remember, consistent effort, discipline, and perseverance are essential for success in RRB exams. Combine your hard work with smart strategies, effective time management, and thorough practice to crack the exam and secure your desired job in Regional Rural Banks.

Common interview questions and how to prepare for them.

When preparing for a bank interview, it's important to familiarize yourself with common interview questions to increase your chances of success. Here are some common interview questions often asked in bank interviews:

1. Why do you want to work in the banking industry?

2. What interests you about this particular bank?

3. Can you describe your knowledge of banking products and services?

4. How do you stay updated on financial and banking trends?

5. What skills do you possess that make you a good fit for a banking role?

6. How do you handle stressful situations, such as dealing with difficult customers?

7. Give an example of a time when you had to work as part of a team to accomplish a goal.

8. How do you ensure accuracy and attention to detail in your work?

9. How would you handle a situation where a customer is dissatisfied with the bank's services?

10. Describe your experience in handling financial transactions and managing cash.

11. How do you prioritize and manage multiple tasks and deadlines?

12. Tell me about a time when you had to solve a complex problem in a previous role.

13. How do you maintain confidentiality and handle sensitive customer information?

14. Give an example of a time when you provided excellent customer service.

15. How do you handle ethical dilemmas or situations where your values are challenged?

Remember, in addition to knowing the common questions, it's also crucial to practice your answers and relate them to your specific experiences and skills. Research the bank you are interviewing with and tailor your responses accordingly. Be prepared to showcase your knowledge of the banking industry and highlight your ability to handle challenges and provide exceptional customer service.

Conclusion:

Regional Rural Bank jobs provide an excellent opportunity to combine a banking career with a social cause. By working in RRBs, you can contribute to the growth and development of rural India, make a positive impact on the lives of rural communities, and build a fulfilling career. Stay determined, prepare strategically, and embark on your journey toward a rewarding career in Regional Rural Banks. You can crack this examination with the help of Nesto Institute. We offer Daily classes, Mock tests etc to increase the ability of students to achieve the job. We are always committed to provide the best Bank exam training in Chennai.